ButSpeak.com

News which Matters.

For the second time in nearly two decades, Japan’s central bank raises interest rates to 0.25%, aiming to strengthen the yen and reduce costs for consumers.

For only the second time in nearly two decades, Japan’s central bank raised interest rates on Wednesday, a strategic move aimed at bolstering the country’s struggling currency and alleviating the burden on consumers facing higher costs for imported essentials such as food and energy.

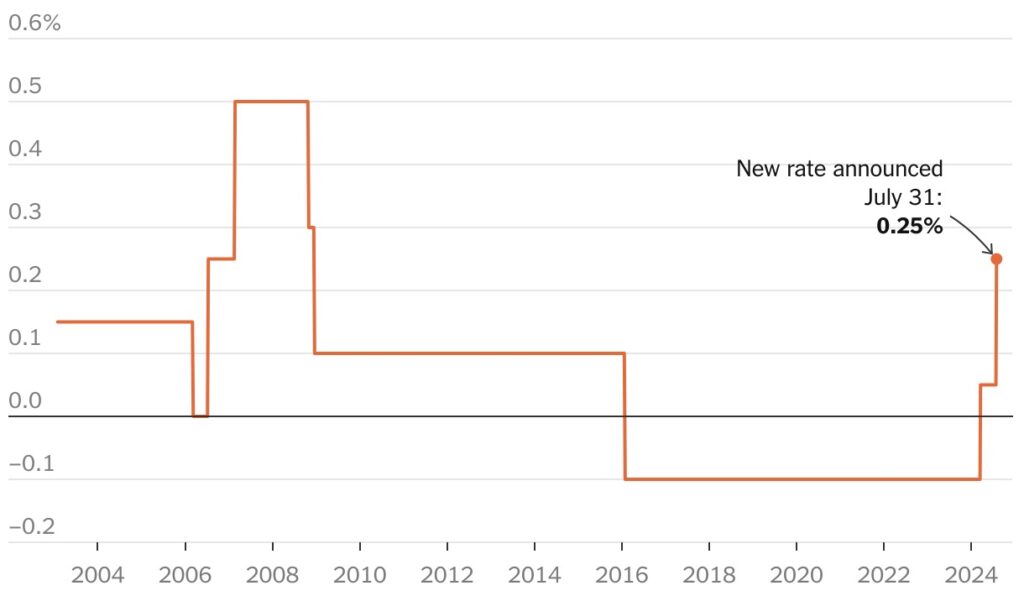

The Bank of Japan increased its target policy rate to 0.25 percent, up from a range of zero to 0.1 percent. This adjustment follows a previous rate hike in March, which marked the first increase since 2007. The significant gap between interest rates in Japan and the United States has led to a depreciation of the yen against the dollar over the past two years. However, the yen has recently regained some strength as traders anticipated the Bank of Japan’s imminent rate increase.

The decision by Japan’s central bank has been closely monitored by investors and economists both within Japan and internationally. There are signs that the weak yen is curtailing the spending power of Japanese consumers, contributing to economic contractions in two of the past three quarters in the world’s fourth-largest economy.

Inflation in Japan has surpassed the policymakers’ target of 2 percent for more than two years, prompting widespread expectations among analysts and economists for at least one more rate increase this year. The latest increase to 0.25 percent represents a significant shift for the Bank of Japan, which has faced increasing pressure to raise rates to prevent the yen—recently trading at its lowest level against the dollar in decades—from depreciating further.

By raising interest rates, the Bank of Japan aims to strengthen the yen, thereby reducing the costs of imported goods for consumers. This move is expected to provide some relief to households that have been struggling with rising prices. As the central bank continues to navigate the challenges of inflation and currency valuation, the recent rate hike is a notable step towards stabilizing Japan’s economy and supporting its consumers.