ButSpeak.com

News which Matters.

Nvidia has leapfrogged Microsoft and Apple to become the world’s most valuable public company, according to S&P Global data. This monumental shift in the stock market comes as a result of the surging demand for Nvidia’s graphics processing units (GPUs), essential for building artificial intelligence (AI) systems.

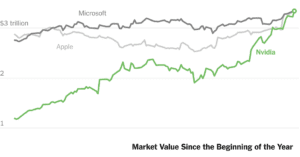

Nvidia’s rapid rise is unprecedented. Just two years ago, the company’s market valuation was a little over $400 billion. Within the span of a year, it has skyrocketed from $1 trillion to more than $3 trillion. On Tuesday, Nvidia’s share price rose 3.6 percent, boosting its market value to $3.34 trillion, surpassing both Microsoft and Apple.

This ascent is a clear indicator of how AI has reshaped the landscape of the world’s largest companies. Initially, the rise of powerful AI technology elevated Microsoft to the top market capitalization in January, dethroning Apple. Nvidia’s breakthrough has now pushed it to take the crown. Last week, Apple announced it, too, was venturing into AI, planning to integrate the technology into its products, including the iPhone, this fall.

Nvidia’s success is largely attributed to its CEO Jensen Huang’s foresight. Years before other major chip companies recognized the potential, Huang bet that GPUs would be crucial for developing AI. He strategically positioned Nvidia to capitalize on this next big technological boom.

The payoff has been substantial. Nvidia now controls over 80 percent of the market for chips used in AI systems by some measures. The company’s largest customers frequently compete for orders to power their data centers, and are even developing their own AI chips to reduce dependency on Nvidia.